When it comes to buying a car, zero-down auto loans sound like a dream come true. Who wouldn’t want to drive off the lot without putting any money down? But while these offers might look attractive on the surface, there are important factors to consider before committing. In this comprehensive, SEO-optimized guide, we’ll break down what zero-down auto loans really mean, the pros and cons, and whether they’re the right financial move for you in 2025.

What is a Zero-Down Auto Loan?

A zero-down auto loan allows you to purchase a vehicle without making an upfront payment. Traditional auto loans usually require a down payment of 10% to 20%, which helps reduce the loan amount and demonstrate your creditworthiness. In contrast, zero-down loans finance 100% of the car’s value.

These loans are often promoted by dealerships looking to move inventory quickly or by lenders seeking to attract buyers with limited savings.

Pros of Zero-Down Auto Loans

- No Upfront Cost:

- You can buy a car without waiting to save up for a down payment.

- Ideal for buyers who need a vehicle urgently but lack immediate funds.

- Immediate Ownership:

- Get behind the wheel faster with minimal financial barriers.

- Preserve Cash Flow:

- Great for those who want to maintain cash reserves for other expenses or emergencies.

- Promotional Incentives:

- Some zero-down deals come with low interest rates, cash back, or deferred payments.

Cons of Zero-Down Auto Loans

- Higher Loan Amount:

- Financing 100% of the car’s value leads to larger loans and, in turn, higher monthly payments.

- Higher Interest Costs:

- Without a down payment, lenders often charge higher interest rates due to increased risk.

- Instant Negative Equity:

- Since cars depreciate quickly, you may owe more than the car is worth as soon as you drive off the lot. This is known as being “underwater” on your loan.

- Stricter Qualification Requirements:

- Lenders may require excellent credit scores and steady income to approve a zero-down loan.

- Greater Risk if You Default:

- With no equity in the car, missing payments can result in repossession without any financial buffer.

Who Should Consider a Zero-Down Auto Loan?

A zero-down loan can make sense in specific situations:

- Excellent Credit Borrowers: Those with high credit scores may qualify for low-interest, zero-down deals that minimize risk.

- Emergency Vehicle Purchase: If your car breaks down and you need immediate transportation, zero-down financing may be the only option.

- High Cash Flow, Low Savings: If you have steady income but haven’t saved for a down payment, this loan offers a fast solution.

- Short-Term Ownership Plans: If you plan to sell or trade the vehicle in a few years, your focus may be on short-term convenience rather than long-term savings.

Who Should Avoid It?

- Poor or Fair Credit Borrowers: These individuals often face high interest rates, making a zero-down loan very expensive.

- Buyers with Tight Budgets: Higher monthly payments may strain your finances.

- Long-Term Vehicle Owners: The long-term costs of interest and depreciation add up significantly without a down payment.

Alternatives to Zero-Down Auto Loans

- Save for a Down Payment:

- Even $1,000 to $2,000 can significantly reduce your loan amount and interest.

- Trade-In Your Current Vehicle:

- Use your car’s equity as a down payment alternative.

- Look for Incentives:

- Automakers often offer low-APR financing or cash back for putting money down.

- Buy a Less Expensive Car:

- Lower the loan burden by choosing a vehicle within your budget range.

How to Get Approved for a Zero-Down Loan

If you decide to go the zero-down route, here’s how to increase your chances of approval:

- Boost Your Credit Score:

- Pay bills on time, reduce existing debts, and check your credit report for errors.

- Provide Proof of Income:

- Lenders will want to see steady employment and a manageable debt-to-income ratio.

- Get Pre-Approved:

- Pre-approval gives you negotiating power and lets you compare offers without hurting your credit score.

- Shop Multiple Lenders:

- Credit unions, online lenders, and dealerships all offer different terms. Compare them before committing.

Understanding the Financial Impact

Let’s break down the numbers:

- With Down Payment:

- Car Price: $30,000

- Down Payment: $6,000 (20%)

- Loan Amount: $24,000 at 4.5% interest for 60 months

- Monthly Payment: $447

- Total Paid: $26,820

- Zero Down:

- Loan Amount: $30,000 at 6.5% interest for 60 months

- Monthly Payment: $587

- Total Paid: $35,220

Difference: You pay $8,400 more without a down payment over the life of the loan.

Protect Yourself with Gap Insurance

Because of the negative equity risk, consider purchasing GAP insurance, which covers the difference between your car’s value and what you owe if your vehicle is totaled or stolen. Some lenders require this for zero-down loans.

Tips to Make a Zero-Down Loan Work for You

- Choose a Reliable, Depreciation-Resistant Vehicle: Brands with strong resale value can help mitigate negative equity.

- Opt for the Shortest Loan Term You Can Afford: Shorter terms mean less interest and quicker equity building.

- Make Extra Payments When Possible: Reduce your balance faster and minimize interest.

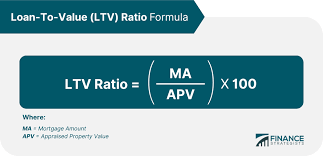

- Track Your Loan-to-Value Ratio (LTV): Aim to reach an LTV under 100% as quickly as possible.

Final Verdict: Are Zero-Down Auto Loans Worth It?

The answer depends on your financial situation, credit profile, and goals. Zero-down loans can offer short-term convenience but often come at a higher long-term cost. If you qualify for a low-interest deal and can manage higher payments without risk, it might be a smart move. However, for many buyers, saving for even a modest down payment can result in better terms, lower interest, and greater financial security.

Conclusion: Make an Informed Choice in 2025

Before jumping into a zero-down loan in 2025, evaluate your budget, credit health, and how long you plan to keep the vehicle. Compare lenders, read the fine print, and consider all the costs involved—not just the lack of an upfront payment. With the right approach, you can make a decision that fits your lifestyle and protects your wallet.