When you’re in the market for a personal loan in 2025, one of the most crucial decisions you’ll need to make is whether to choose a fixed rate or a variable rate loan. This choice can impact everything from your monthly payments to the total amount you’ll repay over time. Understanding the differences—and the pros and cons of each—can help you pick the loan that best suits your financial situation.

In this SEO-optimized guide, we’ll break down fixed and variable rate personal loans, compare their features, and help you decide which option is better for your needs.

What Is a Fixed Rate Personal Loan?

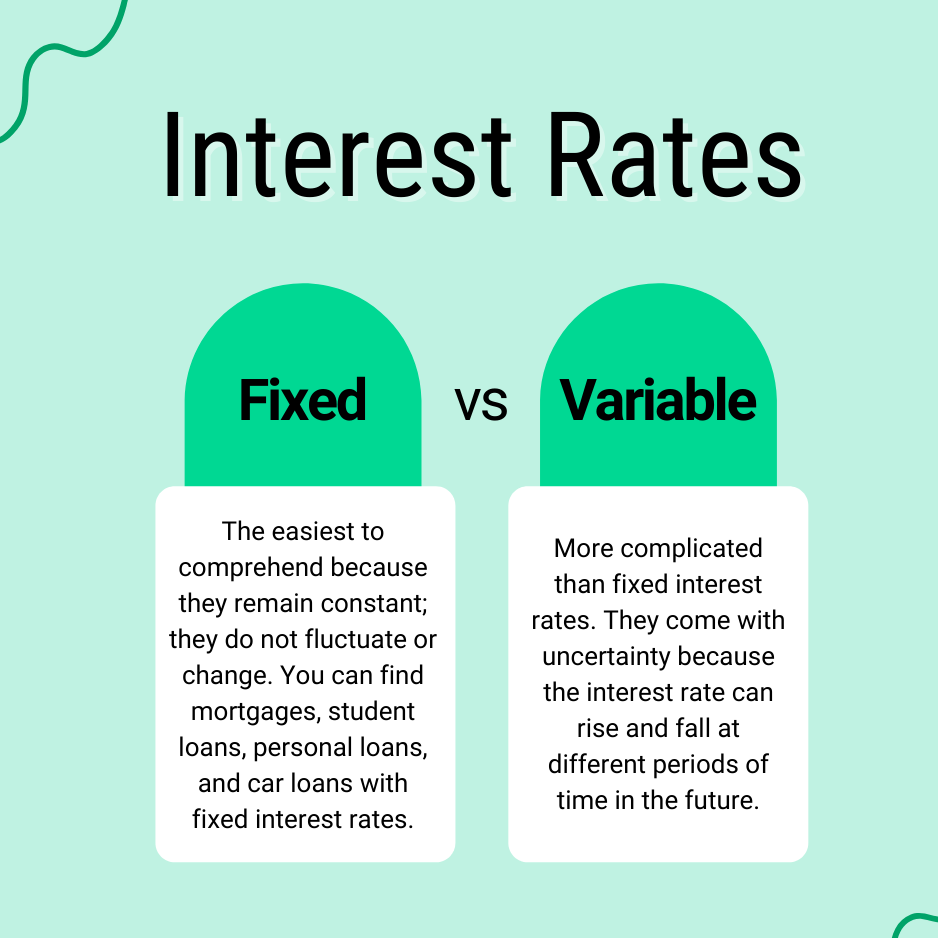

A fixed rate personal loan has an interest rate that stays the same throughout the life of the loan. This means your monthly payment and the total interest paid are predictable and consistent.

🔒 Key Features:

- Fixed interest rate

- Equal monthly payments

- Predictable repayment schedule

✅ Pros:

- Easy to budget due to consistent payments

- Protection from rising interest rates

- Ideal for long-term financial planning

❌ Cons:

- Might start with a slightly higher rate than variable loans

- No benefit if interest rates drop in the future

What Is a Variable Rate Personal Loan?

A variable rate personal loan has an interest rate that can fluctuate over time. It typically starts with a lower interest rate compared to fixed loans, but the rate can increase or decrease depending on market conditions.

🔄 Key Features:

- Interest rate changes with market benchmarks

- Monthly payments may rise or fall

- Often includes a cap on how high the rate can go

✅ Pros:

- Lower initial interest rate

- Potential to pay less if rates drop

- Short-term savings on interest

❌ Cons:

- Payments can increase unexpectedly

- Harder to predict long-term costs

- Not ideal for tight budgets

Fixed vs. Variable: Side-by-Side Comparison

| Feature | Fixed Rate Loan | Variable Rate Loan |

|---|---|---|

| Interest Rate | Constant throughout the loan term | Can fluctuate based on the market |

| Monthly Payments | Consistent | May vary month to month |

| Budgeting | Easier due to predictability | Harder due to fluctuating payments |

| Risk | Low | Moderate to high |

| Starting Interest Rate | Slightly higher | Typically lower |

| Long-Term Cost | More stable | May be higher or lower |

Who Should Choose a Fixed Rate Loan?

Fixed rate personal loans are best for borrowers who:

- Want a predictable monthly budget

- Plan to repay the loan over a longer period

- Are concerned about rising interest rates

- Prefer long-term stability

This type of loan is particularly beneficial for those financing:

- Home improvements

- Debt consolidation

- Major purchases like weddings or medical expenses

Who Should Choose a Variable Rate Loan?

Variable rate personal loans might be a better fit for:

- Borrowers who plan to pay off the loan quickly (within a year or two)

- Those who expect interest rates to remain stable or decrease

- Individuals comfortable with some financial risk

These loans can be ideal for:

- Short-term borrowing needs

- People confident in their income growth

- Those planning to refinance soon

How Market Conditions Affect Your Choice

Interest rate trends in 2025 play a big role in determining which loan type is more advantageous:

- Rising Interest Rates: A fixed rate protects you from increases.

- Stable or Falling Rates: A variable rate might save you money.

🔍 Tip:

Always review economic forecasts or consult a financial advisor to get a sense of where interest rates might be heading.

Real-Life Scenarios

Scenario A: Fixed Rate Loan

- Loan Amount: $10,000

- Term: 36 months

- Fixed Interest Rate: 8%

- Monthly Payment: ~$313

- Total Interest Paid: ~$1,268

Scenario B: Variable Rate Loan

- Loan Amount: $10,000

- Term: 36 months

- Starting Interest Rate: 6% (may increase)

- Monthly Payment (initial): ~$304

- Total Interest Paid (if rate rises): ~$1,500 or more

Bottom Line: While Scenario B starts cheaper, unexpected rate hikes can make it more expensive than the predictable Scenario A.

Questions to Ask Before Deciding

- What is the current interest rate environment?

- How long do I plan to repay the loan?

- Can I handle fluctuating monthly payments?

- Is the lender offering an interest rate cap on the variable loan?

- Will paying extra fees be worth the potential savings?

Tips to Get the Best Deal on Any Personal Loan

- Check Your Credit Score: A better score usually means better rates.

- Compare Lenders: Don’t settle for the first offer—shop around.

- Read the Fine Print: Understand fees, penalties, and interest rate caps.

- Consider Pre-Approval: Get pre-approved to know your options.

- Use Loan Calculators: Run numbers for both fixed and variable loans.

Conclusion: Fixed or Variable—Which Loan is Right for You?

There’s no one-size-fits-all answer when it comes to choosing between fixed and variable rate personal loans. Your decision should depend on your financial goals, risk tolerance, and how long you plan to hold the loan.

- Choose Fixed Rate if you value consistency, want protection against rising rates, and are borrowing for the long term.

- Choose Variable Rate if you expect to pay off the loan quickly and want to take advantage of lower initial rates.

Always review the terms carefully, run the numbers, and consult with a lending expert if you’re unsure. With the right information and strategy, you can secure a personal loan that meets your needs and saves you money.