Fixed vs. Variable Rate Personal Loans: Which Is Better?

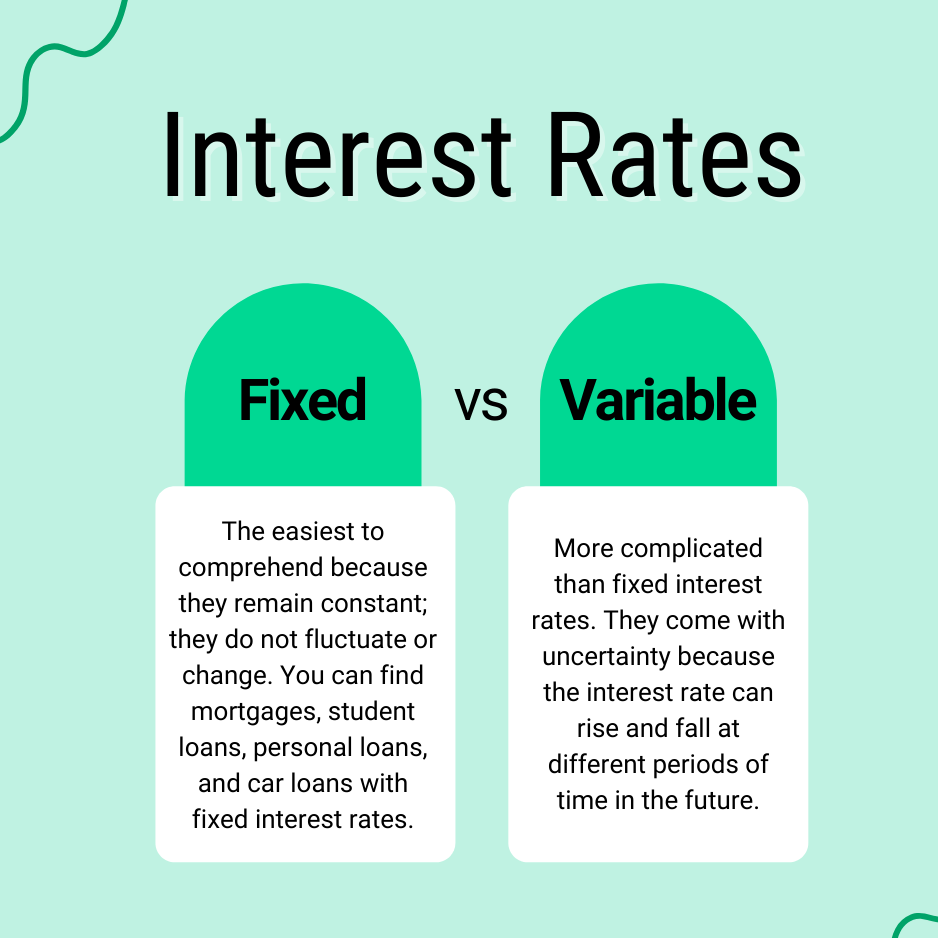

When you’re in the market for a personal loan in 2025, one of the most crucial decisions you’ll need to make is whether to choose a fixed rate or a variable rate loan. This choice can impact everything from your monthly payments to the total amount you’ll repay over time. Understanding the differences—and the pros … Read more